Shipping Insurance Explained

Should I Insure It? Who Handles Shipping Insurance?

The simple answer is YES; it's just $10. However, to help you understand the importance of shipping insurance, you need to assess the likelihood that the item may be lost, damaged, or stolen. This may be a pretty straightforward decision for high-value expensive items, but other considerations include protecting yourself from losing your package and money. You see, nobody in their right mind prays for bad things to happen; neither does anyone expect negative things to happen, but unfortunately, these things happen. That's the world we live in.

Do you know,

- That shady customs officers who inspect packages steals?

- How about undocumented workers who work in the package sorting area of big courier companies?

- How about bad employees within the shipping company who know the price value of your goods and redirect it to a different address?

These things happen more often than you can imagine, but people like to believe that it cannot happen to them until it happens. If your package goes missing, the Insurance company takes the hit while you are protected.

Suppose your package is marked as delivered with photo evidence of the box in your door front, and you claim not to have received it, In that case, that automatically becomes a stolen mail problem.

Disclaimer: Poshglad braided wigs will not be held liable for uninsured missing packages sent to the right shipping address. In addition, our shipping insurance doesn't cover stolen mail to porch pirates. What we cover is from dispatch, transit, and delivery.

For stolen mail complaints,

- First, ask families, friends, or roommates in your house if they received a package for you.

- Ask your neighbors if they saw or collected a package for you.

- Call the courier company and lodge a complaint.

- Inform us about it, for us to help lodge a complaint too.

- Finally, check CCTV footage and report to the police.

Since the coronavirus outbreak in 2019, the world has been a complete mess, stores and shopping centers are closed because of the lockdown, and online shopping skyrocketed. Shipping companies such as FedEx, DHL Express, and UPS are overwhelmed by the high volume of packages, staff shortage, and the implementation of contactless delivery by the government. When workload exceed the number of staff, there is bound to be inefficiency. So, shipping insurance is the best way to protect your package and money against inefficiency. In addition, as summer winds down, many eCommerce sellers are gearing up for holiday planning. It may be warm outside, but thinking ahead to snow and slush and ice gives us the shipping shivers. Anything can and does happen during holiday shipping, and with customer expectations constantly on the rise, shipping insurance is something that should be on your radar.

PLEASE NOTE that our insurance doesn't cover stolen mail to porch pirates, what we cover is the shipping process from dispatch-transit-delivery. In a case of missing or stolen packages en route to your shipping address, we'll inform the shipping company about the claims and then wait for 3-5 business day for their response. If they confirm that the package is undelivered, lost or missing, they'll reimburse us the full amount and we'll send you a new wig or issue you a full refund. Please note that this could take some time to settle because the shipping company and insurance company would likely investigate the claims.

- Declared value: Most carriers and insurers focus on an eCommerce shipper's declared value—what you say it's worth. If that package ends up in a truck that slides into a ditch or under a post-blizzard snowbank and you have to file a claim, it's up to you to prove the item's value. The insurer will pay you that value or the declared amount, whichever is smaller. This means if you sell high-value, high-margin items, you can provide some level of protection by declaring the item's replacement cost to you, the seller, rather than the marked-up retail replacement cost. In the event of loss or damage, you will need to process the claim for your customer and ship them a replacement item. We recommend this only when you are willing to process the claim yourself and when you include insurance in the item's price or a lump sum shipping and handling fee. Still, it can reduce your insurance costs significantly over fully covering the retail value in these cases.

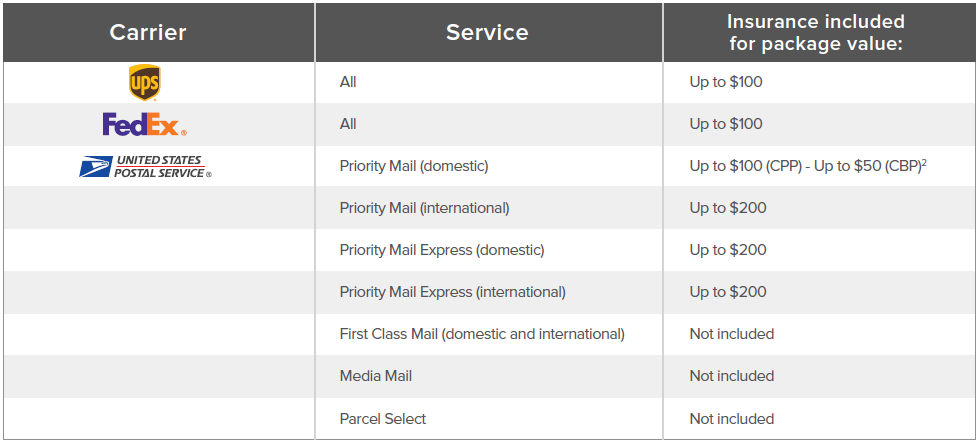

- Items covered by included insurance: All major carriers provide free coverage up to a certain amount (see below). Remember that these limits apply to the entire package, so if you are shipping multiple items in one box that add up to a higher value than the stated limit, you'll need to purchase supplemental insurance if you want them to be fully covered. This is how FedEx defines declared value: http://bit.ly/FedExValue.

- The UPS definition can be found here: http://bit.ly/UPSValue.

For higher value items, be aware that each carrier and shipping insurance providers have limits on insurance maximums. This varies by carrier and includes a maximum by item type and an absolute maximum. For a consolidated list, grab a copy of the guide here.

Another important note is that the declared value covered by carriers doesn't typically cover materials and shipping. Some third-party providers (like Shipsurance, ShippingEasy's insurance partner) will cover packaging and shipping if these costs are included in the declared value and invoiced to the customer.

Consider Risk

There are many considerations here as well when deciding to purchase shipping insurance. Keeping these in mind can help you decide whether to buy the insurance and also help you find ways to mitigate the risk as much as possible.

- Item Type: Certain types of items are more likely to be stolen. For example, those that can be easily resold or pawned, higher-end brand names, and compact and easy-to-grab boxes. They look for brand names, too. So a best practice would be to avoid using the brand box or boxes that may indicate what is inside.

- Destination matters: As unfortunate as it is, some areas are worse for theft and damage than others. This varies widely in the United States, but insuring packages can be a general best practice for international orders, where risk increases. Adding tracking and signature requirements can minimize risk, but carriers will impose coverage limits even in these scenarios. Also, note many third-party insurers will require some basic level of trackability to insure your package.

When considering the business case for insuring packages, a cost and risk analysis can help cement your decision. The below equation, backed by years of data and history, may prove useful.

Translation: If the average cost to insure an item is less than what you spend replacing lost, stolen, or damaged items … then you should include insurance to mitigate the risk.

For example, let's say you sell high-end headphones with an average order value of $200 and ship 100 pairs per month, of which one (1) pair never makes it to the customer's door. 1/100 X 200 = 2, so if it costs less than $2 on average to insure order, it makes business sense for you to buy the insurance. And looking at Poshglad's Shipping insurance rates for this declared value, the cost of supplemental coverage is less than $2 for all domestic shipping scenarios.

Want to learn more about shipping insurance carriers, policies, and procedures, how to file claims, and a more in-depth discussion of the points in this article? Contact us and we will be glad to send you a pdf brochure about shipping insurance.